Date Account Titles and Explanation Debit Credit May 10 May

Date

Account Titles and Explanation

Debit

Credit

May 10

May 18

June 1

Sept. 30

Account Titles and Explanation

Debit

Credit

:

Open Show Work

Problem 153

Solution

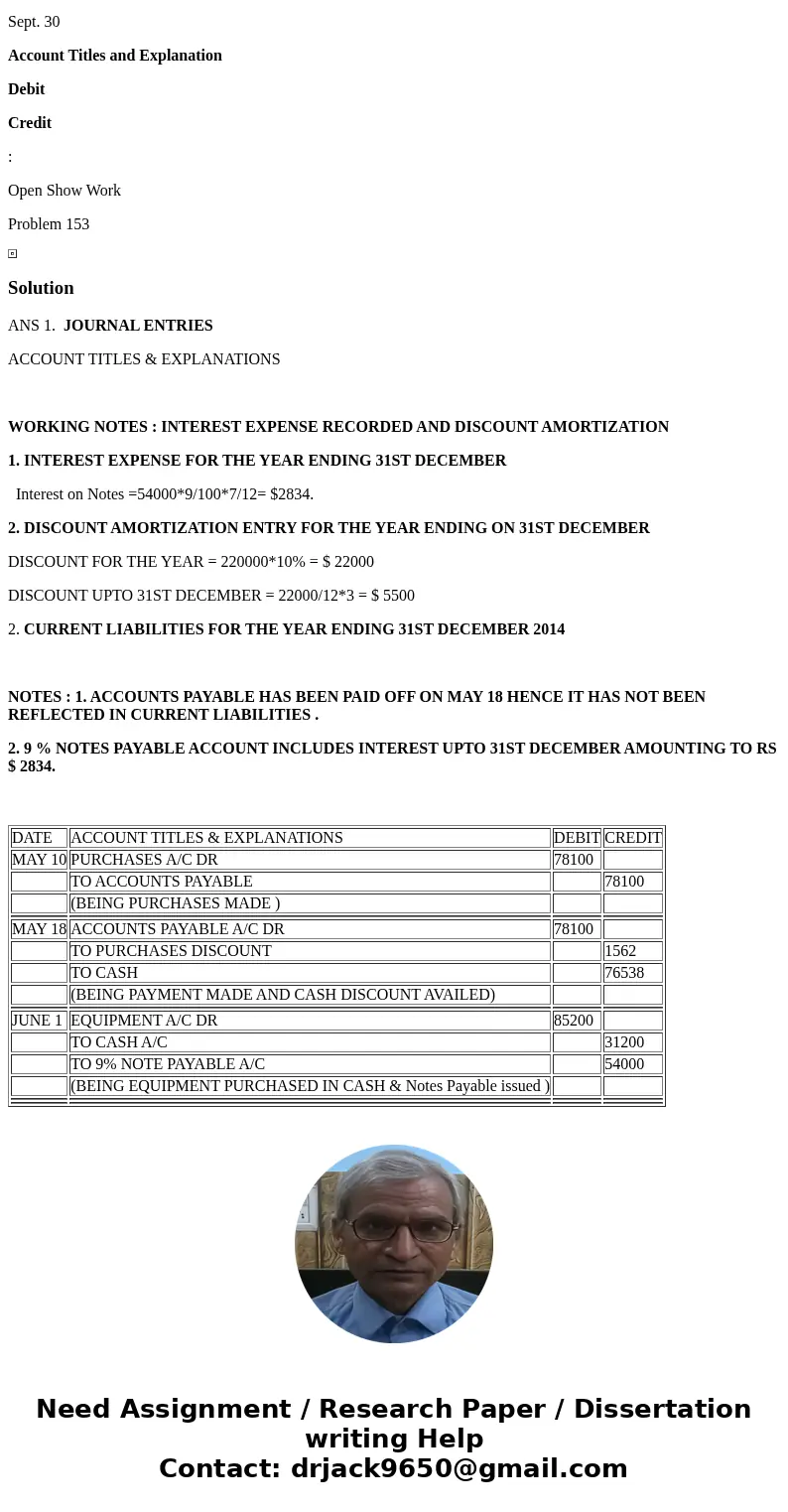

ANS 1. JOURNAL ENTRIES

ACCOUNT TITLES & EXPLANATIONS

WORKING NOTES : INTEREST EXPENSE RECORDED AND DISCOUNT AMORTIZATION

1. INTEREST EXPENSE FOR THE YEAR ENDING 31ST DECEMBER

Interest on Notes =54000*9/100*7/12= $2834.

2. DISCOUNT AMORTIZATION ENTRY FOR THE YEAR ENDING ON 31ST DECEMBER

DISCOUNT FOR THE YEAR = 220000*10% = $ 22000

DISCOUNT UPTO 31ST DECEMBER = 22000/12*3 = $ 5500

2. CURRENT LIABILITIES FOR THE YEAR ENDING 31ST DECEMBER 2014

NOTES : 1. ACCOUNTS PAYABLE HAS BEEN PAID OFF ON MAY 18 HENCE IT HAS NOT BEEN REFLECTED IN CURRENT LIABILITIES .

2. 9 % NOTES PAYABLE ACCOUNT INCLUDES INTEREST UPTO 31ST DECEMBER AMOUNTING TO RS $ 2834.

| DATE | ACCOUNT TITLES & EXPLANATIONS | DEBIT | CREDIT |

| MAY 10 | PURCHASES A/C DR | 78100 | |

| TO ACCOUNTS PAYABLE | 78100 | ||

| (BEING PURCHASES MADE ) | |||

| MAY 18 | ACCOUNTS PAYABLE A/C DR | 78100 | |

| TO PURCHASES DISCOUNT | 1562 | ||

| TO CASH | 76538 | ||

| (BEING PAYMENT MADE AND CASH DISCOUNT AVAILED) | |||

| JUNE 1 | EQUIPMENT A/C DR | 85200 | |

| TO CASH A/C | 31200 | ||

| TO 9% NOTE PAYABLE A/C | 54000 | ||

| (BEING EQUIPMENT PURCHASED IN CASH & Notes Payable issued ) | |||

Homework Sourse

Homework Sourse